Call: +1 913-733-2733

Address: 210 SW Market St, STE 121, Lee's Summit MO 64063

Email:[email protected]

Expert Service. Expert Results.

Expert Financial.

Unlock Your Future with a Strong Credit Profile - We'll Help You Get There!

How It Works

Identifying the Problems

At Expert Financial, the first step to improving your credit is identifying the inaccuracies that are lowering your score. We achieve this through a comprehensive credit analysis. Once we pinpoint the issues, we'll provide you with the necessary information to take action, remove those inaccuracies, and ultimately enhance your credit score. We’ll support you throughout the entire process, ensuring you’re informed and guided at every stage. Our mission is solely focused on helping you restore and strengthen your credit rating

Challenging the Bureaus

Once we've identified all unverifiable, inaccurate, or misleading information, we input it into our system to start the challenging process of addressing these issues. We will dispute the information with the credit bureau, creditors, and collectors, sending out formal dispute letters to each party. This process typically takes 30 to 40 days as we await their responses and updates. At Expert Financial, we’re committed to guiding you through every step and working diligently to restore your credit from start to finish.

Analyzing the Updated Reports

Once we receive the updated reports from the credit bureaus, we carefully review them to confirm whether the inaccurate, unverifiable, or misleading information has been removed or corrected. If the issues remain unresolved, we will reach out to the reporting entities to inquire about why the information wasn't amended. If the report has been updated, we proceed to address the next item that requires dispute.

Weekly Education

Throughout the credit restoration process, Expert Financial will equip you with the knowledge and resources needed to improve your credit score. We'll provide guidance on what it takes to rebuild your credit effectively. Additionally, we offer products such as credit monitoring and credit builder accounts, which can support you in restoring and maintaining a healthy credit score.

WHY CHOOSE US

Our Services

Repair

The initial step to restoring your financial health is to remove any inaccuracies from your credit report. Under the law, every consumer has the right to dispute and challenge any information on their credit report that they believe is incorrect.

Rebuild

The next step in restoring your credit is to focus on rebuilding it as we work on removing inaccurate information. Simply removing negative items isn't enough; you also need to demonstrate to FICO and your creditors that you can consistently make your payments on time.

Raise Your Score

The third step in restoring your credit is to concentrate on boosting your credit score. A strong credit score is crucial for loan approval, as a low score can lead to denials or higher interest rates.

Client Testimonials

"Loved everything so far"

"Expert Financial was able to help me with all my needs! Well worth the time & investment."

- Satisfied Client

"My life changed forever"

"This team is LEGIT. After less than 60-days, my life changed forever - THANK YOU!"

- Satisfied Client

"Highly recommend this"

"Loved working with the team. I was kept in the loop the entire program. 1000% recommend."

- Satisfied Client

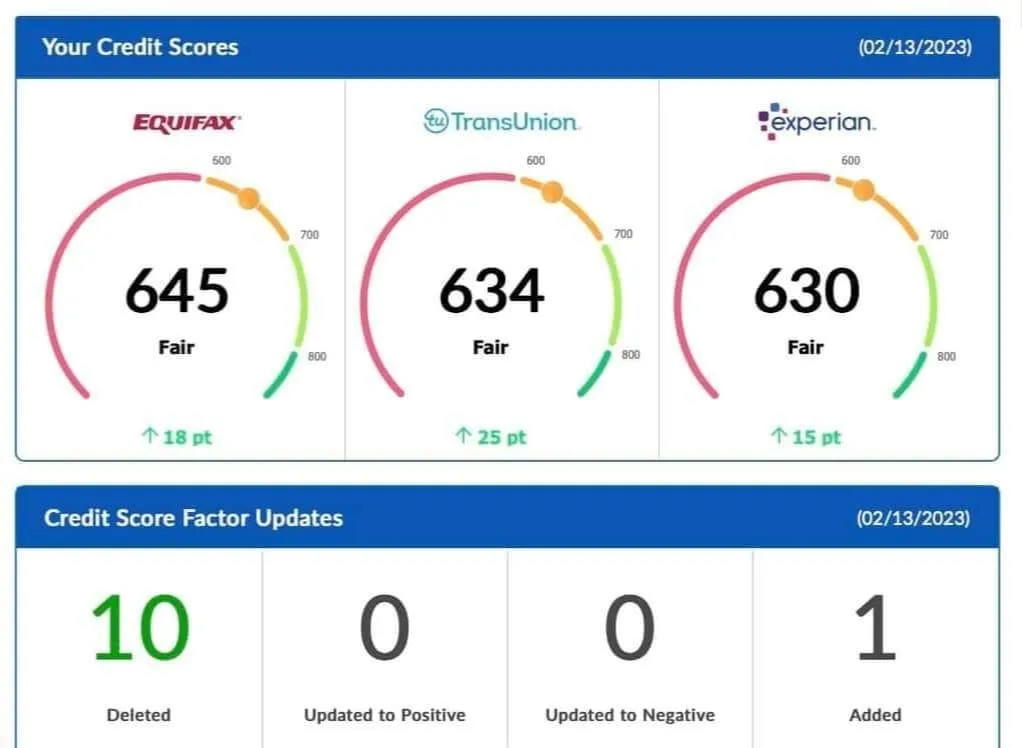

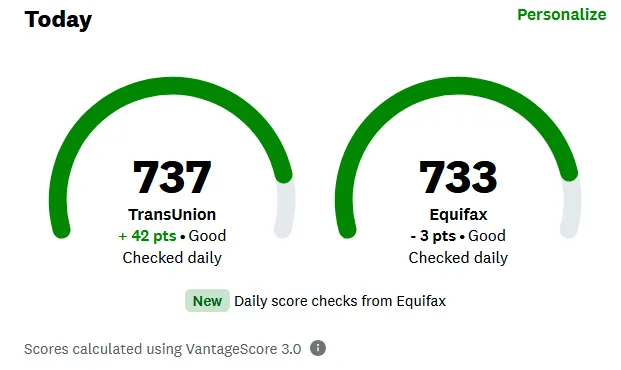

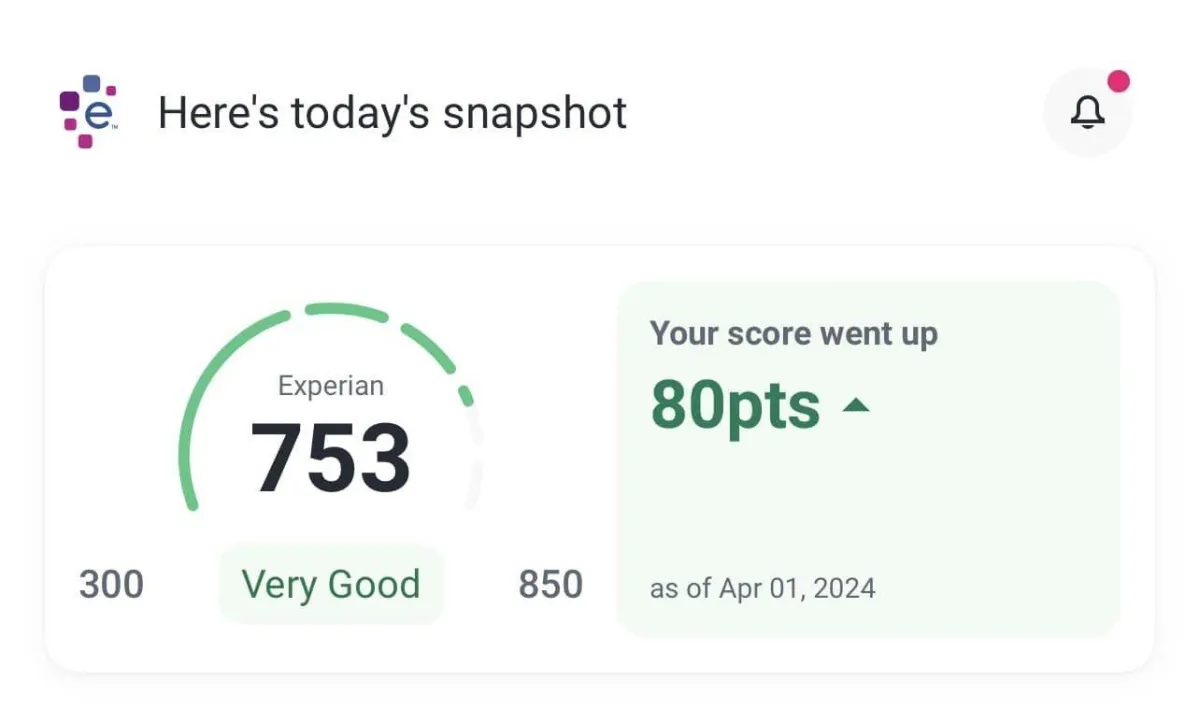

Client Results

Frequently Asked Questions

Is Credit Repair Legal?

Absolutely! Credit repair is 100% legal under the Fair Credit Reporting Act (FCRA), a federal law that protects consumers' rights. The FCRA gives you the right to dispute any inaccurate, outdated, or unverifiable items on your credit report. If the credit bureaus or creditors cannot verify the accuracy of an item within a reasonable time frame (usually 30 days), they are required to remove it.

Here’s why this matters: Studies reveal that 79% of credit reports contain errors, meaning nearly 8 out of 10 reports could benefit from immediate improvements. At Expert Financial, we leverage the law to challenge these inaccuracies and ensure your credit report is 100% accurate, verifiable, and timely.

Even for items that are not outright errors, creditors or furnishers often fail to provide the necessary documentation within the allotted time. In such cases, these items are removed. If a furnisher claims an item is verified but doesn’t provide proof, our team steps in to prepare expertly crafted disputes that challenge these claims. We are highly skilled in navigating these processes to help you achieve the credit score you deserve.

What items can be removed from my credit report?

We work to remove a wide range of negative items, including:

Bankruptcies

Foreclosures

Collections

Charge-offs

Repossessions

Medical bills

Credit card debt

Late payments

Inquiries

Tax liens

Judgments

Student loans

Our team leverages credit laws to dispute these items and improve your credit score quickly!

How long does it take to repair credit for a home purchase?

At Expert Financial, most clients start seeing noticeable credit score improvements in as little as 60-90 days. While the complete process typically takes 6-8 months, our streamlined approach ensures you’re on the path to homeownership faster than you think!

For most home loans, a minimum credit score of 640 is recommended. However, a score of 700+ can significantly boost your approval chances and help you secure lower interest rates, saving you thousands over the life of your loan!

Why are results different?

Credit repair results can vary from person to person due to several factors, including:

Unique Credit Profiles: No two credit reports are the same! The types and number of negative items, such as collections, charge-offs, or late payments, can impact how quickly changes occur.

Responsiveness of Credit Bureaus and Creditors: Credit bureaus and creditors have up to 30 days (sometimes longer) to respond to disputes, and their responsiveness can vary.

Verification of Disputed Items: If a creditor or furnisher cannot verify an item within the allotted time, it must be removed. However, some creditors may respond faster or provide documentation, which affects the outcome.

Ongoing Financial Habits: Your current financial behaviors, like paying bills on time, reducing debt, and avoiding new credit inquiries, play a significant role in improving your credit score.

Number of Negative Items: Clients with fewer negative items may see faster results, while those with more complex reports may require additional rounds of disputes.

At Expert Financial, we tailor our approach to your specific credit situation to maximize results. Our team works diligently to dispute all negative items in every round, ensuring no delay in the process. Plus, we provide weekly education, credit monitoring, and tools like credit builder accounts to help you maintain and rebuild healthy credit.

What makes Expert Financial different from other credit repair companies?

Expert Financial stands out because:

We dispute all negative items in every round—no delays, no shortcuts.

Credit monitoring is included in every plan.

We offer a 180-day money-back guarantee if we cannot help.

Our clients enjoy a 90% success rate in qualifying for home loans after using our services.

Still Undecided? Let's Chat.

TRY IT RISK FREE

100% Money Back Guarantee

If we are unable to help your situation within 180-days, we will refund you all payments.

Call: +1 913-733-2733

Address: 210 SW Market St, STE 121, Lee's Summit MO 64063

Email:[email protected]

Facebook

Instagram

X

LinkedIn

Youtube

TikTok